Academics & Admissions

Federal Financial Aid is funds that come from the United States government. This aid includes grants and loans as well as work study programs. Many of these programs are based on your family income.

MNU shall not assign any first-time borrower’s education loans, through award packaging or other methods, to a particular lender. Nor shall the University refuse to certify, or delay certification of, any loan based on the borrower’s selection of a particular lender or guaranty agency.

No officer, employee, or agent of MidAmerica Nazarene University shall solicit or accept any “gift” from a lender, guarantor, or servicer of education loans. “Gift” includes any gratuity, favor, discount, entertainment, hospitality, loan, or other item having monetary value of more than a de minimus amount. This prohibition also applies to gifts to family members of the above individuals when the gift was given with the knowledge and acquiescence of such individual, and the individual has reason to believe the gift was given because of such individual’s official position.

MidAmerica Nazarene University will not enter into any “revenue-sharing arrangement” with any lender. A “revenue-sharing arrangement” is an arrangement whereby the University recommends to students and family a lender of educational loans, and then in exchange, the lender pays a fee or provides other material benefits, including revenue or profit-sharing, to the University, or an officer, employee, or agent of the University.

No officer or employee of MidAmerica Nazarene University who is employed in the financial aid office or otherwise has responsibilities with respect to education loans, or an agent who has responsibilities with respect to education loans, shall accept from any lender or affiliate of any lender any fee, payment or other financial benefit (including the opportunity to purchase stock) as compensation for any type of consulting arrangement or other contract to provide services to a lender or on behalf of a lender relating to education loans.

MidAmerica Nazarene University shall not request or accept from any lender any assistance with call center staffing or financial aid office staffing. However, this prohibition does not preclude requesting or accepting assistance from a lender related to: (1) professional development training for financial aid administrators, (2) providing educational counseling, financial literacy or debt management materials to borrowers that identify the lender who assisted in preparing or providing the materials, or (3) staffing services on a short term, nonrecurring basis to assist MNU with financial aid-related functions during emergencies.

No employee who is employed in MidAmerica Nazarene University’s financial aid office, or who otherwise has responsibilities with respect to education loans or other student financial aid of the University, and who serves on an advisory board, commission, or group of lenders or guarantors, shall be permitted to receive anything of value from the lender, guarantor, or group of lenders or guarantors, except for reimbursement for reasonable expenses incurred in serving on such advisory board, commission, or group.

The National Student Loan Data System (NSLDS) is the central database used by the U.S. Department of Education for student aid. Loan and enrollment information will be submitted to NSLDS, and that information will be accessible by guaranty agencies, lenders and schools authorized to be users of the data system. Students may log into NSLDS to get information on the history of your Pell Grant, Perkins Loan, and Federal Direct Loans, including loan servicer information and reported enrollment information.

The Office of Student Financial Aid Services uses a standard academic year for students enrolled in our traditional program. This year spans two enrollment terms (semesters). The terms total at least 30 weeks of instruction. A full-time student is expected to complete at least 24 credit hours during an academic year.

Verification is a procedure in which some students are requested to document certain data elements on the FAFSA—including but not limited to income and family size. Primary documents collected are the IRS transcripts for the student and the parents if the student is a dependent. A verification worksheet must also be completed.

MidAmerica Nazarene verifies all students who are selected by the Department of Education and may use its discretion in selecting students for verification. If selected for verification, no Federal financial aid funds will be credited to a student’s account until the verification process is complete.

Students owing the University at the end of a semester will not be permitted to enroll for another semester without making satisfactory financial arrangements with the Bursar.

Transcripts will not be released until all accounts have been paid in full and Perkins loans, if any, are in good standing. When clearing a past due student account to receive a transcript, payment must be made by cashier’s check, credit card or personal money order if immediate clearance is needed. If payment is made by personal check, a waiting period of 15 days is necessary for the check to clear the bank.

Graduating students must have their accounts paid in full before participating in graduation exercises and receiving diplomas.

All financial aid must be applied to the account balance before the student receives credit balances.

Institutional scholarships must be applied to tuition, fees, and residential charges. After these charges are paid, any excess amount will be returned to the scholarship fund. Cash refunds can only be created by outside funded scholarships or loans.

Full-time status is defined as taking 12 or more credits in a semester. Three-quarter-time status is defined as taking 11 credit hours in a semester. One-half-time status is defined as 8 credit hours a semester. Only the Federal Pell Grant is available for qualified students taking fewer than 6 credit hours a semester.

In order to maintain eligibility for financial aid, a student must make adequate academic progress toward his or her degree. Eligibility for federal financial aid is terminated if a student takes longer than 150% of the time established to complete his/her course of study. Students must successfully complete 66.67% of attempted cumulative credits.

For students transferring to MNU, the total number of credit hours accepted by MNU will be included in the number of attempted and completed credit hours in calculations for Satisfactory Academic Progress.

All undergraduates must achieve a minimum cumulative grade point average (GPA) to maintain financial aid Satisfactory Academic Progress (see link below). These cumulative GPA requirements are monitored at the end of each semester.

See the entire Satisfactory Academic Process Policy.

The University insurance plan is also available for part-time students. Enrollment is through the Student Accounts Office. Once the Student Accounts Office is notified, the premium charge will appear on a student’s term bill. Please email studentaccounts@mnu.edu to be included in the semester enrollment if you are enrolled part-time.

Dependent coverage is not available under this plan.

NOTE: If a full-time student drops down to part-time status, the Health Insurance charge will automatically be removed from the student’s account. However, if a student uses the insurance prior to removal of the coverage, the Student Accounts Office will manually charge the student’s account at the full amount for the <semester.rel=”noopener”>Online Form Information

Federal Financial Aid is funds that come from the United States government. This aid includes grants and loans as well as work study programs. Many of these programs are based on your family income.

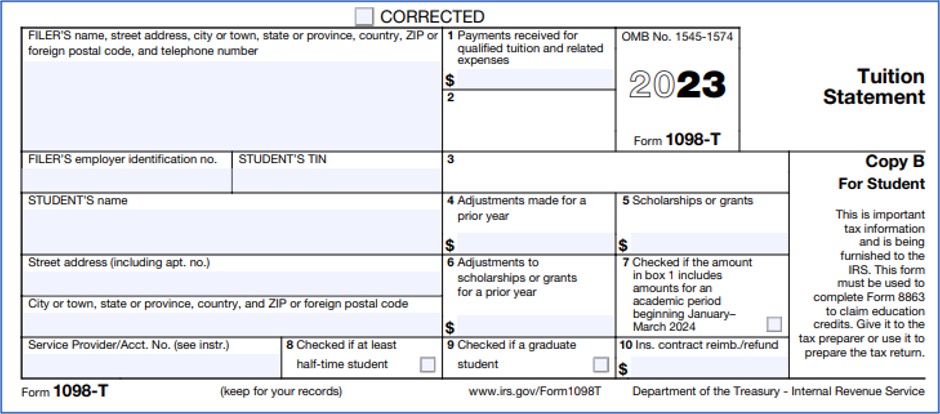

MidAmerica Nazarene University offers view access to your 1098-T forms online through our student accounts partner, Self Service Banner. All students eligible for a 1098-T form for the year will be able to see an electronic version of their 1098-T online. MNU may need to get updated tax information from you. If this is the case, please click the link below to print out the W-9 form. Fill out the form and return it to MNU as soon as possible.

10/3/18 – Change of Reporting Method for Tax Year 2018 – Box 1 Reporting Required for 2018 Tax Year

In previous years, your 1098-T included a figure in Box 2 that represented the qualified tuition and related expenses (QTRE) we billed to your student account for the calendar (tax) year. Due to a change to institutional reporting requirements under federal law, beginning with the tax year 2018 reporting, we will report in Box 1 the amount of QTRE you paid during the year.

Depending on your income (or your family’s income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970.

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863 – the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

MidAmerica Nazarene University is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser.

For more information about Education Credits AOTC and LLC, visit https://www.irs.gov/credits-deductions/individuals/education-credits-aotc-llc.

The Student Accounts & Cashiers Office is located on the 1st floor of the Lunn Building. Their office hours are Monday through Friday 8:30 a.m. to 4:30 p.m. except Tuesday when they open after Chapel at 10:45 a.m. Phone: 913-971-3504

October 10, 2023: This report 00703200-HEERF_Q32023_101023.pdf is the 3rd quarter report for the Federal HEERF MNU. $7,637.30 was spent on a HyFlex Classroom.

This report 00703200-HEERF_Q32023_101023.pdf is the 3rd quarter report for the Federal HEERF MNU. $7,637.30 was spent on a HyFlex Classroom.

This report 00703200-HEERF_Q22023_071023.pdf is the 2nd quarter report for Federal HEERF MNU. $29,612.00 was spent for Competency Based Education.

This report, 00703200_HEERF_Q42022_011023, is the 4th quarter report for both Federal HEERF for students and MNU. This quarter, $50,968.00 were awarded for students, and MNU had $19,759.23 reported for COVID-related expenses and lost revenue.

Federal HEERF emergency financial aid grants to students were made possible under (a)(1) of the CARES Act, CRRSAA, and ARP (Student Aid Portion).

The report 00703200_HEERF_Q22022_071122 is both the Federal HEERF for Student and MNU.

$354,780 was directly awarded to 1,097 students as Emergency Financial Aid Grants and MNU had $53,015.64 in COVID related expenses paid by the Federal HEERF grant for institutions.

Federal HEERF II and III Update for Institutional Funds

Please see the 00703200_HEERF_Q42021_010722 for details for first quarter of 2022. $300,135.32 was drawn from Federal HEERF II and III Funds COVID-related first quarter expenses.

Federal HEERF II and III Update for Students Funds

Federal HEERF emergency financial aid grants to students were made possible under (a)(1) of the CARES Act, CRRSAA, and ARP (Student Aid Portion).

Federal HEERF I, II and III awarded for MNU Students totaled $2,913,062. The remainder of Federal HEERF II funds were awarded to 2 students and $457.00 disbursed for fourth quarter 2021. As of December 31, 2021, a total of 731 students have been awarded between $500 and $2,000 for Federal HEERF II totaling $599,857.

Federal HEERF III funds have been awarded to 578 students for a total of $757,000.00 for fourth quarter ending December 31, 2021. A total of $588,848 is yet to be awarded from Federal HEERF III.

As stated in the July 15, 2021 HEERF Update, the American Rescue Plan (HEERF III) made available $1,713,348.00 to be awarded to students that qualify for the funds. Enrolled students at MNU during the Fall 2021 semester, on census date, will automatically receive grants based on the highest financial needs. Students who have submitted a Free Application for Federal Student Aid for 2021-2022 with an expected family contribution of 20,000 or less will be awarded the following:

Expected Family Contribution of $0 to $5,846 receives $1,500

Expected Family Contribution $5,847 to $20,000 receives $1,200

Federal HEERF II funds were awarded to 20 students and $12,300 disbursed for third quarter 2021. As of September 30, 2021, a total of 729 students have been awarded between $500 and $2,000 for Federal HEERF II totaling $599,400. A balance of $457.00 will be awarded in the next quarter.

As of September 30, 2021 Federal HEERF III funds have been awarded to 245 students @ $1,500.00 for a total of $367,500.00. An estimated 655 students are eligible to receive Federal HEERF III funds.

Higher Education Emergency Relief Fund (HEERF II) grants were awarded to students with exceptional need based on the 2020-2021 FAFSA.

As of today, April 27, 2021, 659 students have received between $500 and $2,000 for a total of $560,600.00

Coronavirus Response and Relief Supplemental Appropriations Act: (CRRSAA) was signed into law on December 27, 2020, which gave the U.S. Department of Education funds to distribute to institutions of higher education through the Higher Education Emergency Relief Fund (HEERF II). MidAmerica Nazarene University received $599,857.00 on February 22, 2021 to distribute to students to help with emergency expenses due to COVID-19.

MNU will begin awarding Higher Education Emergency Relief Fund (HEERF II) grants starting March 17, 2021. Stage 1 of the HEERF II grants will be awarded to students with exceptional need based on the 2020-2021 FAFSA. For the initial round of awards, students with an EFC (Expected Family Contribution) of $0-$200 will be given the opportunity to complete the application. Students must explain how they have been impacted by COVID-19 to be eligible to receive funding.

Students may use the grants toward:

If funds are still available after the first round of awards, another round of students will be invited to apply based on their EFC.

This report, 00703200_HEERF_Q12023_041023, is the 1st quarter report for Federal HEERF MNU. This quarter, no funds were awarded for students, as all available funds were totally expended in 2022. MNU expensed $308.00 for COVID-related expenses for the 1st quarter 2023.

The report, 00703200_HEERF_Q32022_101022.pdf, is the 3rd quarter report for both Federal HEERF for students and MNU. In this quarter, no funds were awarded for students, and MNU had $1,057,469.20 reported for COVID-related expenses and lost revenue.

Enrolled students who do not qualify as stated above or have not filed a FAFSA will have the opportunity to apply using an application verifying covid-related expenses.

$1,000 grants will be available for regular students not in the above exceptional need student populations as well as international, DACA, undocumented and other non-citizens.

Grants will be provided until funds are exhausted.

Federal HEERF II and III Update for Students Funds

Federal HEERF emergency financial aid grants to students were made possible under (a)(1) of the CARES Act, CRRSAA, and ARP (Student Aid Portion).

Federal HEERF III funds have been awarded to 165 students for a total of $183,100.00 for first quarter ending March 31, 2022. A total of $405,748 is yet to be awarded from Federal HEERF III.

Federal HEERF II and III Update for Institutional Funds

Please see the 00703200_HEERF_Q12022_040822 for details for first quarter of 2022. $300,135.32 was drawn from Federal HEERF II and III Funds COVID-related first quarter expenses.

Federal HEERF II funds were awarded to 20 students and $12,300 disbursed for third quarter 2021. As of September 30, 2021, a total of 729 students have been awarded between $500 and $2,000 for Federal HEERF II totaling $599,400. A balance of $457.00 will be awarded in the next quarter.

As of September 30, 2021 Federal HEERF III funds have been awarded to 245 students @ $1,500.00 for a total of $367,500.00.

An estimated 655 students are eligible to receive Federal HEERF III funds.

Please see the 00703200_HEERF_Q32021_101021 for details for third quarter of 2021. $1,303,923 was drawn from Federal HEERF II and III Funds for prior years and current period COVID-related expenses and lost revenue.

The U.S Department of Education has provided additional funds since the Coronavirus Aid, Relief, and Economic Security Act (HEERF I). Coronavirus Response and Relief Supplemental Appropriations Act (HEERF II) made available $599,857.00 on February 22, 2021 to be awarded to students that qualify for the funds; and on April 9, 2021 $1,612,783.00 was made available to MNU for expenses associated with significant instructional delivery as a result of the coronavirus.

The American Rescue Plan (HEERF III) made available $1,713,348.00 to be awarded to students that qualify for the funds; and on May 15, 2021 made available to MNU $1,595,026.00 for institutional expenses. The student funds will be awarded in the 2021-2022 school year.

The HEERF III Student funds will be awarded according to the following criteria:

• All students enrolled Fall census date will be eligible for funds;

• Eligibility amount will be based on full-time; ¾ time, half-time, or less than half-time enrollment (prorated based on enrollment status on the census date;

• The only mechanism for funds distribution will be ACH, so students must set up an ACH account for funds to be distributed;

• Eligibility amount will be determined after the census date when eligible students and enrollment status can be determined.

The remainder of HEERF II will be awarded once ACH forms are completed and HEERF III funds will be awarded in the fall semester.

Higher Education Emergency Relief Fund (HEERF II) grants were awarded to students with exceptional need based on the 2020-2021 FAFSA.

As of June 30, 2021, 709 students have received between $500 and $2,000 for a total of $587,100

MNU has awarded a total of $599,857.00 (the amount of $437,250.00 was inadvertently reported here 3-31-21; corrected 4-26-21) for the Higher Education Emergency Relief Fund (HEERF II) grants. Stage 1 of the HEERF II grants were awarded to students with exceptional need based on the 2020-2021 FAFSA.

For the initial round of awards, students with an EFC (Expected Family Contribution) of $0-$200 were given the opportunity to complete an application. Students had to explain how they have been impacted by COVID-19 to be eligible to receive funding.

Stage 2 was for students enrolled in the Spring Semester, who filed a FAFSA with an EFC of $5,711 or less. They were given a $500 base payment amount. These students were all given the opportunity to apply for additional funds based on COVID-related expenses they have incurred.

The IRS has an FAQ page that may address student questions about the HEERF grant they received: https://www.irs.gov/newsroom/faqs-higher-education-emergency-relief-fund-and-emergency-financial-aid-grants-under-the-cares-act

2030 E. College Way

Olathe, KS 66062-1899

913-782-3750 or 800-800-8887